Section 332(c)(2) of the Communications Act says that “a private mobile service shall not . . . be treated as a common carrier for any purpose under this Act.”

So of course the Federal Communications Commission on Thursday declared mobile data roaming (which is a private mobile service) a common carrier. Got it? The law says “shall not.” Three FCC commissioners say, We know better.

This up-is-down determination could allow the FCC to impose price controls on the dynamic broadband mobile Internet industry. Up-is-down legal determinations for the FCC are nothing new. After a decade trying, I’ve still not been able to penetrate the legal realm where “shall not” means “may.” Clearly the FCC operates in some alternate jurisprudential universe.

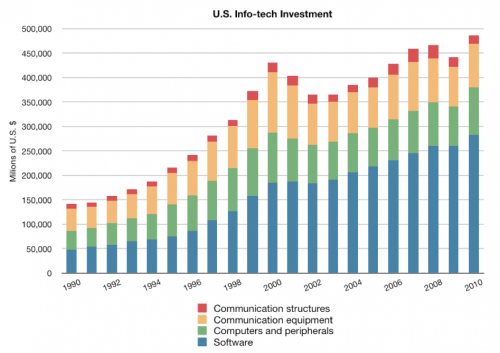

I do know the decision’s practical effect could be to slow mobile investment and innovation. It takes lots of money and know-how to build the Internet and beam real-time videos from anywhere in the world to an iPad as you sit on your comfy couch or a speeding train. Last year the U.S. invested $489 billion in info-tech, which made up 47% of all non-structure capital expenditures. Two decades ago, info-tech comprised just 33% of U.S. non-structure capital investment. This is a healthy, growing sector.

As I noted a couple weeks ago,

You remember that “roaming” is when service provider A pays provider B for access to B’s network so that A’s customers can get service when they are outside A’s service area, or where it has capacity constraints, or for redundancy. These roaming agreements are numerous and have always been privately negotiated. The system works fine.

But now a group of provider A’s, who may not want to build large amounts of new network capacity to meet rising demand for mobile data, like video, Facebook, Twitter, and app downloads, etc., want the FCC to mandate access to B’s networks at regulated prices. And in this case, the B’s have spent many tens of billions of dollars in spectrum and network equipment to provide fast data services, though even these investments can barely keep up with blazing demand. . . .

It is perhaps not surprising that a small number of service providers who don’t invest as much in high-capacity networks might wish to gain artificially cheap access to the networks of the companies who invest tens of billions of dollars per year in their mobile networks alone. Who doesn’t like lower input prices? Who doesn’t like his competitors to do the heavy lifting and surf in his wake? But the also not surprising result of such a policy could be to reduce the amount that everyone invests in new networks. And this is simply an outcome the technology industry, and the entire country, cannot afford. The FCC itself has said that “broadband is the great infrastructure challenge of the early 21st century.”

But if Washington actually wants more infrastructure investment, it has a funny way of showing it. On Sunday at a Boston conference organized by Free Press, former Obama White House technology advisor Susan Crawford talked about America’s major communications companies. “[R]egulating these guys into to an inch of their life is exactly what needs to happen,” she said. You’d think the topic was tobacco or human trafficking rather than the companies that have pretty successfully brought us the wonders of the Internet.

It’s the view of an academic lawyer who has never visited that exotic place called the real world. Does she think that the management, boards, and investors of these companies will continue to fund massive infrastructure projects in the tens of billions of dollars if Washington dangles them within “an inch of their life”? Investment would dry up long before we ever saw the precipice. This is exactly what’s happened economy-wide over the last few years as every company, every investor, in every industry worried about Washington marching them off the cost cliff. The White House supposedly has a newfound appreciation for the harms of over-regulation and has vowed to rein in the regulators. But in case after case, it continues to toss more regulatory pebbles into the economic river.

Perhaps Nick Schulz of the American Enterprise Institute has it right. Take a look. He calls it the Tommy Boy theory of regulation, and just maybe it explains Washington’s obsession — yes, obsession; when you watch the video, you will note that is the correct word — with managing every nook and cranny of the economy.