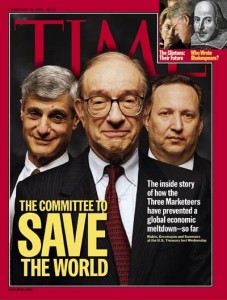

Robert Rubin famously was part of the “Committee to Save the World,” so dubbed by Time magazine, as he, Alan Greenspan, and Larry Summers supposedly prevented the Asian flu of 1997-98 from spreading around the globe.

But finally — finally — the mainstream press is wondering whether Rubin’s reputation over the years was justified. From today’s Wall Street Journal:

Mr. Rubin’s salary made him one of Wall Street’s highest-paid officials — and a controversial figure among Citigroup shareholders and some executives, who questioned whether his limited duties justified the big paydays.

“Even though he has no ‘operating’ responsibilities, he still has a fiduciary responsibility as a board member,” said William Smith, a New York money manager and frequent critic of Citigroup’s current management and board. “He has overseen the entire meltdown, yet been compensated as an operating employee while bragging about having no operating responsibility.” Mr. Rubin can’t “have it both ways,” Mr. Smith added.

Somehow, the most central factor — the fundamental cause — of both the late-90s Asian meltdown and our current crisis — namely monetary and dollar policy — has escaped much criticism. Yes, the argument that Alan Greenspan and Ben Bernanke held interest rates too low for too long in the 2003-06 period can now be discussed in polite company. But it often is thought to be peripheral, or more often it just gets lost in all the chaos.

The late-90s mistake was just the opposite of this decade’s easy-credit mistake, with predictable mirror image effects. Back then, Greenspan and Rubin held a super-tight squeeze on dollars, pushing the dollar ever higher versus foreign currencies and commodities, crushing all dollar-debtors across the globe, from Thailand, Indonesia, and Korea, to Turkey, Russia, and Argentina. The world’s capital abandoned hard assets and flooded into the U.S. in general and into our soft, intellectual assets like Microsoft, Cisco, and dot-coms in particular. Eventually, after the “Committee to Save the World” had worked its magic and basked in its cover-boy status, the deflationary Greenspan/Rubin policy in 2000 toppled the U.S. markets, too.

Mr. Rubin likes to offer his wisdom “in an uncertain world” — the title of his memoir. But the world would be much less uncertain if the Rubin-Greenspan-Bernanke-Snow-Paulson monetary/dollar policy weren’t so manic.

P.S. Yes, to reiterate, these are supreme cases of the arsonist posing as heroic fireman.