A critique of Carmen Reinhart and Ken Rogoff’s paper examining debt’s effect on growth dominated the economic news over the last week. Reinhart and Rogoff’s 2010 offering, Growth in a Time of Debt, compiled lots of data on debt-to-GDP ratios from nations around the globe and found that higher debt ratios, especially those at 90% or above, tended to be associated with slower growth. Three UMass-Amherst economists, however, noticed an error in R&R’s spreadsheet and argued that it (along with two other statistical choices) significantly altered the results. R&R acknowledged the spreadsheet error in a reply but defended the thrust of their work and its conclusions.

Champions of government spending jumped on the critique, charging that the R&R paper had given aid and comfort to widespread “austerity” policies and that their now-discredited ideas had sunk the world economy. They dubbed it “The Excel Depression.”

Others who have reviewed all the evidence, however, found R&R’s research holds up rather well. Harvard’s Greg Mankiw basically agrees and thinks

The coding error in Reinhart and Rogoff has gotten a lot more media attention than it deserves.

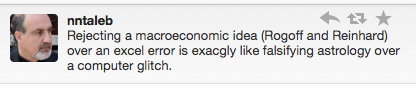

Then there is the entertaining contrarian Nassim Nicholas Taleb, who, in a tweet, goes further:

The coding error, I agree, is not remotely dispositive in this very big debate. So where does that leave us? We’ve still got these enormous debts, slow growth, and a still-yawning intellectual chasm on all the big public finance and monetary policy issues. As some have pointed out, a problem with this type of research is causation. Even if R&R are correct about the correlation, in other words, does high debt cause slow growth, or does slow growth cause high debt? These questions really get to the heart of economics and, like Taleb, I’m skeptical conventional macro is very enlightening.

We’ve been debating these very topics for centuries, or millennia. In The History of England, for example, Thomas Babington Macaulay reminded us of his nation’s apparently insurmountable debts following the interminable wars of the seventeenth and eighteenth centuries.*

When the great contest with Lewis the Fourteenth was finally terminated by the Peace of Utrecht the nation owed about fifty million; and that debt was considered not merely by the rude multitude, not merely by fox hunting squires and coffee-house orators, but by acute and profound thinkers, as an encumbrance which would permanently cripple the body politic . . . .

Soon war again broke forth; and under the energetic and prodigal administration of the first William Pitt, the debt rapidly swelled to a hundred and forty million. As soon as the first intoxication of victory was over, men of theory and men of business almost unanimously pronounced that the fatal day had now really arrived.

David Hume said the nation’s madness exceeded that of the Crusades. Among the intellectuals, only Edmund Burke demurred. “Adam Smith,” Macaulay continued,

saw a little, and but a little further. He admitted that, immense as the pressure was, the nation did actually sustain it and thrive. . . . But he warned his countrymen even a small increase [in debt] might be fatal.

Thus Britain’s attempt to tax its American colonies to pay down its debts. And thus another war — the Revolutionary — and thus another 100 million in new debts. More wars stemming from the French Revolution pushed Britain’s debts to 800 million, surely beyond any possibility of repayment.

Yet like Addison’s valetudinarian, who continued to whimper that he was dying of consumption till he became sofat that he was shamed into silence, [England] went on complaining that she was sunk in poverty till her wealth showed itself by tokens which made her complaints ridiculous . . . .

The beggared, the bankrupt society not only proved able to meet all its obligations, but while meeting these obligations, grew richer and richer so fast that the growth could almost be discerned by the eye . . . . While shallow politicians were repeating that the energies of the people were borne down by the weight of public burdens, the first journey was performed by steam on a railway. Soon the island was intersected by railways. A sum exceeding the whole amount of he national debt at the end of the American war was, in a few years, voluntarily expended by this ruined people on viaducts, tunnels, embankments, bridges, stations, engines. Meanwhile, taxation was almost constantly becoming lighter and lighter, yet still the Exchequer was full . . . .

Macaulay pinpointed the chief defect in the thinking of the alarmists.

They made no allowance for the effect produced by the incessant progress of every experimental science, and by the incessant effort of every man to get on in life. They saw that the debt grew and they forgot that other things grew as well as the debt.

Does this mean the spendthrifts are right? That we can — indeed, should — spend our way out of our predicaments, without much regard for the growing debt?

No.

A defect of the debt alarmists may be their curmudgeonly suspicion that budget imbalances always drive the economy downward. An even more egregious defect of the debt apologists, however, is their assumption that budget imbalances lift the economy upward and that spending is equal to growth, rather than a result of growth. The debt alarmists too often forget the possibilities of human achievement that are the basis for wealth. The debt apologists, however, assume wealth is inevitable, that it can be redistributed, and that their policies will have no harmful impact on wealth creation. The crucial point in Macaulay is not that any nation can sustain growing debts but that vibrantly growing economies (like that of the scientifically-advanced, exploratory, industrial British Empire) can sustain debts in larger amounts than is commonly assumed.

The debt alarmists, moreover, play into the hands of the spendthrifts. By making budget balance their sine qua non of policy, they equate spending restraint with tax increases. The spendthrifts say “fine, if budget balance is so important, let’s raise taxes.” Never mind the possible negative growth effects of higher tax rates (and regulations and the like). This is what has happened in much of Europe and now to some extent in the U.S. An obsession with debt too often impels policies that slow economic growth — real economic growth, based on productivity and innovation, not spending — thus greatly exacerbating the burden of debt. And make no mistake, the burdens of debt are real. Defaults, inflations, and bankruptcies happen. If interest rates rise several percentage points, the U.S. might be paying hundreds of billions more in interest. And this is why the shortened term structure of our debt is an even bigger concern. We should have been locking in very long terms at these historically low rates.

Like the British Empire, with its pound sterling, the U.S. has a great advantage in the dollar’s status as world reserve currency. We are probably able to sustain higher debts than would otherwise be the case because our debts are in our own currency and the safe haven status of Treasurys. Yet, how did the pound sterling or the dollar achieve reserve status? Through powerful economic growth of the currencies’ issuers.

In the current growth and policy environment, America’s debts are a substantial worry. Yet no policy should focus first on debt. We should ask whether each policy encourages or discourages entrepreneurship and real productivity enhancements. And whether each spending program is legitimate, effective, and efficient. If policy were driven, more often than not, by thoughtful answers to these questions, then the debt question would answer itself. Our debt ratio would likely decline, yet the amount of debt our economy could sustain would rise.

Here is David Malpass concisely making the point on CNBC:

— Bret Swanson

* Macaulay quotes from George Gilder’s book Wealth & Poverty.