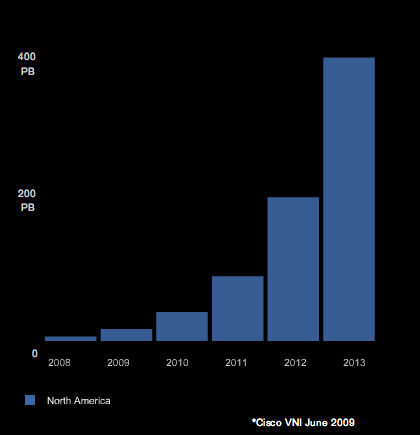

For years we’ve been talking about the need for more wireless bandwidth, more spectrum, and a host of creative new strategies to complement our mobile phone networks — from familiar Wi-Fi to more exotic femtocells and satellites. The continuing explosion of mobile data traffic means we need these things now more than ever. In the graph below, Cisco projects 120% compound annual growth in North American mobile data from 2009 through 2013.

The Federal Communications Commission recognized these trends and needs in its new National Broadband Plan. It set the bold goal of unleashing 500 MHz of mostly dormant wireless spectrum for more productive use in new broadband Internet and media applications.

On March 29, the FCC had a chance to begin putting its Plan into action when it approved the acquisition of SkyTerra by Harbinger Capital. The result of the merger is a new wireless company that will use both MSS satellite spectrum and so-called ATC terrestrial spectrum to deliver a new hybrid mobile service. Harbinger announced it would build a nationwide, wholesale, “open access” 4G broadband wireless network at the cost of $6 billion. Although not part of the FCC’s 500 MHz push, the new Harbinger strategy aligns nicely with the goal of more, better, and broader wireless access and options throughout the country (in this case, Canada, too).

But the FCC order, which was not voted by the full commission but issued by the bureau chiefs, contains two curious provisions. The provisions restrict Harbinger’s cooperation with two important mobile service providers and could hinder the very goal of extending more wireless coverage to more Americans.

In an attachment to its acquisition approval, the FCC said Harbinger may not lease capacity or otherwise partner with the two largest U.S. mobile phone companies — Verizon and AT&T — without the FCC’s prior permission. The FCC also barred Verizon and AT&T, should any cooperative agreement or lease be allowed, from consuming more than 25% of the bytes carried in any “Economic Area.” Quite baffling, and as far as I know, unprecedented.

The broad effect of these restrictions will be to reduce flexibility and growth in this fast-moving arena, to restrict much needed spectrum in key geographies from the companies that serve more than half of all Americans, and to place an unnecessary obstacle in the way of a wireless upstart seeking to bring more capacity and competition to the mobile world.

Many were already skeptical Harbinger could pull it off, the FCC order notwithstanding. Too expensive, too technically demanding, they say, too much competition, with the existing carriers and the likes of ClearWire. But instead of clearing the way for a small competitor to make a go of it, the FCC is adding burdens to Harbinger’s daunting task.

If you were starting a business, one with very large upfront capital costs, how would you like Washington telling you that your two largest potential customers are off limits? The FCC conditions make Harbinger’s proposed network neither “wholesale” nor “open access.” More like a boutique continental 4G wireless network. Sound good? Didn’t think so.

The FCC order could also effectively bar 176.3 million American mobile phone users (Verizon’s 91.2 million customers, AT&T’s 85.1 million) from taking advantage of this new spectrum. We are always looking for ways to expand robust coverage, whether in dense high-usage cities or in tough-to-serve rural, mountain, and coastal areas. Harbinger’s eclectic strategy is to combine both satellite resources and terrestrial repeaters both to add capacity to major markets and to serve out-of-the-way North America. But a large number of American mobile customers could now be blocked from this unique way to expand coverage.

What’s bizarre about this FCC order is that it so pointedly offends its own strategy, laid out just weeks ago in its major National Broadband Plan. The FCC dedicated lots of time and energy to wireless. “Goal No. 2” of the Plan is:

The United States should lead the world in mobile innovation, with the fastest and most extensive wireless networks of any nation.

Within the large section on Spectrum, the FCC highlighted its priorities under these major headings:

5.2 ENSURING GREATER TRANSPARENCY CONCERNING SPECTRUM ALLOCATION AND UTILIZATION

5.3 EXPAND INCENTIVES AND MECHANISMS TO REALLOCATE OR REPURPOSE SPECTRUM

5.6 EXPAND OPPORTUNITIES FOR INNOVATIVE SPECTRUM ACCESS MODELS

Transparency? Seriously, now. This order, issued by the bureau chiefs and not the Commissioners, gave no opportunity for input by the mobile carriers, who were not even party to the transaction. They were not consulted or even notified. Harbinger, meanwhile, was at the mercy of the FCC staff. You want your acquisition approved? Then these are the conditions you’ll have to swallow. This was a case study in opaque spectrum policy.

Expand incentives to repurpose spectrum and for innovative access models? Talk about contracting incentives to repurpose spectrum and encourage new innovations, such as Harbinger’s unique and speculative satellite-4G hybrid system.

I’m no lawyer, but the FCC conditions seem awfully arbitrary. Policy-making by mere whim. Unaccountable, off the cuff, and blatantly contrary to its own shiny new Broadband strategy.

I doubt these conditions on the Harbinger order can stand. But regardless, let’s hope this episode is not a portent of Broadband policy to come.

— Bret Swanson