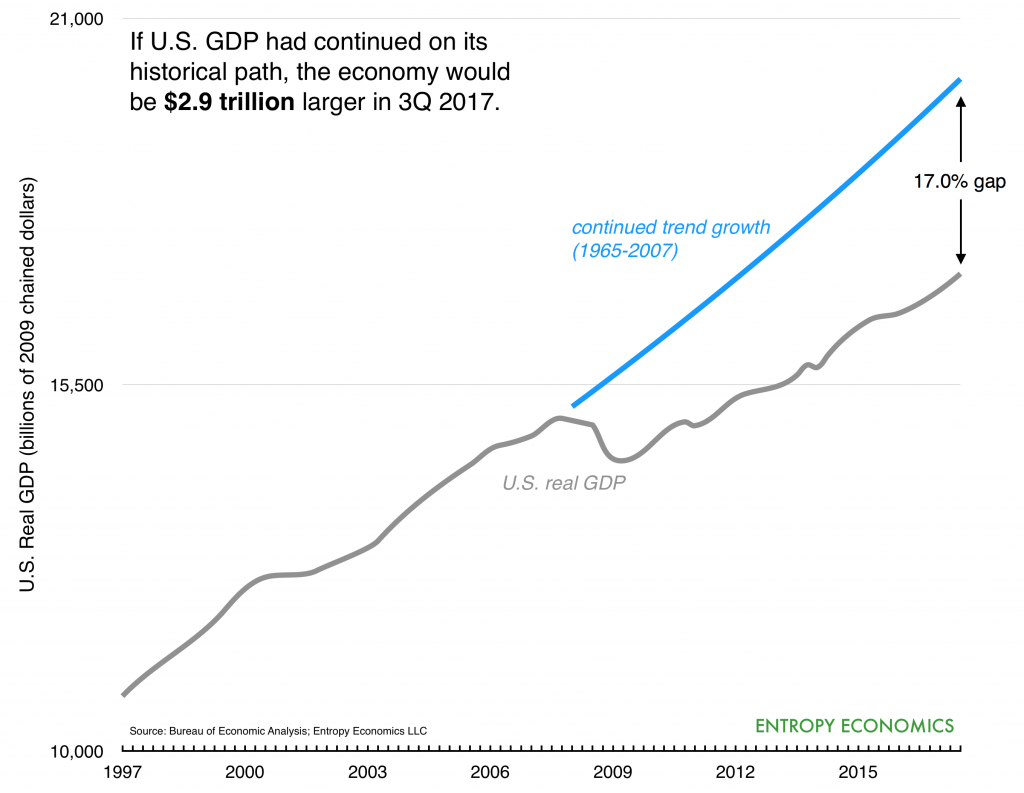

It’s fascinating to see those commentators and economists, who insisted for nearly a decade that 2% was the best the U.S. could do, grapple with the apparent uptick in economic growth and improving labor markets. Secular stagnation, technological stagnation, financial recessions are different, better get used to the “new normal” – these were the explanations (excuses?) for the failure of the economy to recover from the Panic of 2008. Millions of Americans had permanently dropped out of the labor market, robots were taking their jobs, or (paradoxically) technology was impotent, an aging population meant the U.S. would never grow faster than 2% again, and a global dearth of demand meant the economy would be stuck for many years to come. Wages for most workers weren’t growing, and inequality increased because of monopolies or greed or . . . whatever – anything but a failure of policy to encourage growth. Only bigger government could restart the stagnating secular engine, but even then, don’t expect too much.

All of the sudden, however, we’re hearing stories of tight labor markets, and 2017 will likely exhibit the fastest growth for a calendar year since 2006. We think there are three key reasons for the 2017 uptick: (1) an abrupt cessation of the anti-growth policy avalanche; (2) dramatic policy improvements, such as wide-ranging regulatory reforms and a major tax overhaul; and (3) the beginnings of a tech-led productivity freshening.

As Adam Ozimek (@ModeledBehavior) writes:

This story is both very happy but also does make me mad, because I think there hasn’t been a reckoning. This mistake was in a sense bigger than failing to predict the Great Recession, because it was more of an unforced error. And there is no similar push for economist rethinking

— Adam Ozimek (@ModeledBehavior) January 14, 2018

It’s refreshing to hear a mainstream economist call out the massive failure of the last decade – a devastating “growth gap” that we’ve been railing against for many years (also, e.g., Beyond the New Normal; Technology and the Growth Imperative; Uncage the Economy; etc.). It’s more than a little odd, however, that Ozimek singles out for criticism several economists who were arguing that the economy could have been growing much faster, if we’d let it, and were suggesting policies that could help boost employment. Shouldn’t he specifically call out the stagnation apologists instead? Isn’t the “giant mistake,” as Ozimek calls it, the insistence the economy was growing as fast as possible and the arguments that diverted attention from bad policy, unnecessarily slow growth, stagnating wages, and a huge drop in employment?

Many stagnationists are now searching for possible explanations for the nascent uptick. Some are looking toward a possible resurgence of technology and the idea that productivity growth might improve from its decade-long drop. Larry Summers says the apparent uptick is merely a “sugar high” that won’t last. But you can see many of the stagnationists labor to avoid any acknowledgement that better policy might be at the heart of economic improvement. (By the way, I’m thrilled that our tech-led “Productivity Boom” thesis is getting this attention. The recent converts, however, seem to say that a new tech-boom is now inevitable, when just months or weeks ago they said tech was over. I think the policy improvements of 2017 will accelerate technological innovation in many lagging sectors.)

It’s too early to know whether these encouraging signs are the beginning of a long-term growth acceleration. But it’s good to see lots of people finally acknowledge the depth of the growth gap and the higher innovative potential of the American economy.