On Tuesday afternoon, Apple said it earned $13 billion in the fourth quarter on $46 billion in revenue. Thirty-seven million iPhones and 15 million iPads sold in the quarter helped boost its market cap to $415 billion. A few hours later, Indiana Gov. Mitch Daniels, in his State of the Union response message, contrasted the technology juggernaut with Washington’s impotent jobs efforts: “The late Steve Jobs – what a fitting name he had – created more of them than all those stimulus dollars the President borrowed and blew.”

First thing Wednesday morning, however, Paul Krugman countered with a devastating argument – “Mitch Daniels Doesn’t Read the New York Times.” Prof. Krugman referred to the first of the Times‘ multipart series on Apple’s Chinese manufacturing operations.

From Sunday’s Times:

Not long ago, Apple boasted that its products were made in America. Today, few are. Almost all of the 70 million iPhones, 30 million iPads and 59 million other products Apple sold last year were manufactured overseas.

…

Apple employs 43,000 people in the United States and 20,000 overseas, a small fraction of the over 400,000 American workers at General Motors in the 1950s, or the hundreds of thousands at General Electric in the 1980s. Many more people work for Apple’s contractors: an additional 700,000 people engineer, build and assemble iPads, iPhones and Apple’s other products. But almost none of them work in the United States. Instead, they work for foreign companies in Asia, Europe and elsewhere, at factories that almost all electronics designers rely upon to build their wares.

Steve Jobs designed great products. It’s very, very hard to make the case that he created large numbers of jobs in this country. Obama’s auto bailout, just by itself, saved a lot more jobs than Apple’s US employment.

So the New York Times thinks all those Chinese Foxconn assembly workers are the primary employment effect of Apple. And Prof. Krugman sidesteps the argument by noting the “auto bailout” – not the stimulus – “saved” – not created, mind you – more jobs than Apple’s under-roof American workforce.

CNNMoney jumped in:

Daniels’ math just doesn’t add up, no matter how successful and valuable Apple has become.

Not even close.

This little episode exposes quite a lot about the fundamentally different ways people think about the economy.

The economy is dynamic and complex. It’s a cooperative, competitive, and evolutionary. In recent pre-Great Recession history, the U.S. lost around 15 millions jobs every year — holy depression! But we created some 17 million a year, netting two million. There’s no way to quantify Jobs’ jobs impact exactly, which is one of the great virtues of capitalism.

An attempt to estimate in a very rough way, however, might be useful:

Apple

Apple has 60,000 total employees, around 43,000 in U.S.

Multiply these numbers by the years these jobs have existed, decades in the case of many. That’s many hundreds of thousands of “job-years.”

Then consider the broad software industry, especially the world of “apps” being developed for iPhone and iPad, and now for Macs. More than 500,000 iOS apps now exist, and 1.2 billion were downloaded in the last week of December 2011. Lots of people are trying to quantify how many jobs this app ecosystem has created. Likely it will mean many tens of thousands of jobs for decades to come, meaning hundreds of thousands of job-years, though even the “app” won’t look this way forever or even for long. We’ll see.

Apple computers, iPhones, iPads, and multimedia software, like OSX, iOS, Quicktime, and WebKit, drive the Internet and wireless industries. (WebKit is an open software platform developed by Apple that most people have never heard of. But it’s crucial to Internet browsers and webpage development.) These devices allow people and companies to create content. They improve productivity and create new kinds of jobs. How many graphic designers would we have had over the years without the Mac?

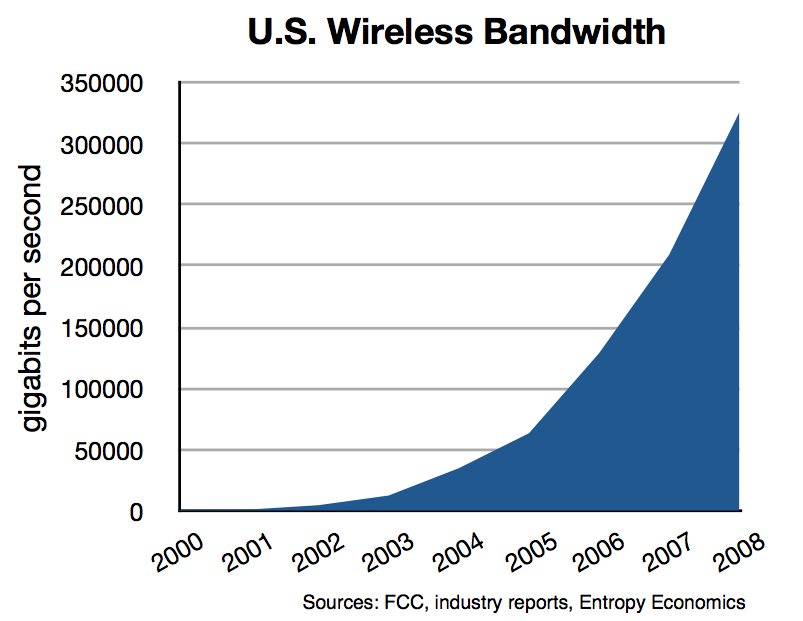

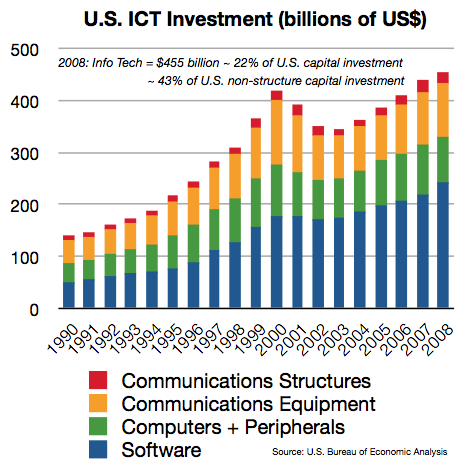

Apple devices devour bandwidth and storage and drive new generations of broadband and mobile network build-outs, totaling about $65 billion per year in the U.S. So add some significant portion of networking equipment salesmen and telecom pole-climbers and Verizon and Comcast workers and data center technicians. The iPhone alone completely reinvigorated the U.S. mobile industry and ushered in a new paradigm of computing, moving from PC to mobile device. Apple jolted AT&T back to life when the two companies partnered on the first iPhone. How many jobs across the economy did the iPhone “save” by boosting our digital industries when the PC era had about run its course? A lot.

Jobs created a new digital music industry. It’s impossible to gauge how many jobs were created versus eliminated. But clearly the new jobs are higher value jobs.

Apple is now the largest buyer of microchips in the world. It buys 23% of all the world’s flash memory, for example. Much of that is South Korean. But Apple probably buys something like 20 million Intel microprocessors each year. That’s a huge part of Intel’s business. Intel employs 100,000 people (not all in the U.S.).

The notion that “almost none” of the “additional 700,000” people who contribute to designing and building Apple products work in the U.S. is false. And silly.

Apple’s list of suppliers includes many of America’s leading-edge technology companies: Qualcomm, Intel, Corning, LSI, Broadcom, Seagate, Micron, Analog Devices, Linear, Maxim, Marvell, International Rectifier, Western Digital, ON Semi, Nvidia, AMD, Cypress, Texas Instruments, TriQuint, SanDisk, etc.

Lots of Apple’s foreign suppliers have substantial workforces in the U.S. Oft cited are the two Austin, Texas, Samsung fabs, which employ 3,500 workers who make NAND flash memory and Apple’s A5 chip. But many Asian and European Apple suppliers have sales, marketing, and support staff in America.

And of course no government or stimulus jobs are possible without private wealth creation. During the “stimulus” period — 2009-11 — Apple paid $16.5 billion in corporate income taxes, thus financing about 2% of the entire $821 billion stimulus package and thus 2% of the stimulus “jobs.” One might counter that stimulus was funded with debt, but money is fungible, and issuing debt depends on future claims on wealth. Moreover, because stimulus jobs were so extraordinarily expensive, a different accounting says that Apple’s $16.5 billion in taxes could have paid for 330,000 $50,000-a-year salaries.

Pixar

In 1986, Steve Jobs bought a tiny division of George Lucas’s LucasFilm and created what we know as Pixar, the leading movie animation studio. In 2006, Pixar merged with Walt Disney. Disney has 156,000 employees and $41 billion in sales, a growing portion of which directly or indirectly relate to Pixar properties, film development, characters, licensing, and distribution. Pixar really saved Hollywood during a dark time for film and spawned a whole new animation boom. Pixar developed and inspired many new technologies for film making, video games, and other interactive visual media.

An additional consideration: Over the 2009-11 period, Disney paid $7 billion in income taxes, thus financing just under 1% of the stimulus and 1% of the “jobs.” That $7 billion could have funded 140,000 $50,000-a-year salaries.

Macro

The economy-wide effects of Steve Jobs are of course impossible to measure with precision. But a new study from Robert Shapiro and Kevin Hassett estimates that advances in mobile Internet technologies boosted U.S. employment by around 400,000 per year from 2007 to 2011, or by a total of around 1.2 million over the 2009-11 stimulus period. The Phoenix Center found similar employment effects. What proportion of these can be attributed to Steve Jobs is, again, impossible to say. But it’s clear Apple was the primary innovator in mobile Internet technologies in this period, towering over a multitude of other important technologies. More than any other device, the iPhone exploited the new, larger-capacity 3G mobile networks of the period, and once it proved wildly popular it was the chief impetus for additional 3G mobile capacity.

Stimulus

CBO estimates ARRA (the Stimulus bill) yielded between 1.3 and 3.5 million job-years net, meaning created or saved. But as the stimulus wanes, many of these jobs go away, or at least are not attributable to the stimulus.

Robert Barro of Harvard questions whether ARRA created any jobs at all. He says the question isn’t whether the Keynesian multiplier is greater than 1 (meaning break even; spend $1, get $1 in GDP), let alone whether it’s 1.5 (spend a dollar, get $1.50), but whether the multiplier is greater than zero.

Stanford’s John Taylor also thinks ARRA had no positive effect.

And do stimulus-boosters really want to equate these two activities?

(1) the federal government pays a state worker’s salary for a year instead of the state paying the salary;

(2) a new job derived from an entrepreneur who’s created whole new industries with new kinds of higher value jobs that last for decades, spurring yet more growth and jobs.

In Keynesian macro world those two jobs are equivalent, I guess.

The CNNMoney report acknowledged the 43,000 U.S. employees of Apple and also the 850 employees of Pixar at the time it merged with Disney in 2006. It even allowed that perhaps Pixar could employ twice as many people now. It also grudgingly admitted that maybe some Americans are building apps for the App Store. That’s about it.

This imprecise exercise misses the deeper truths of entrepreneurial capitalism and short-changes the dynamic versus static view of the economy. In a new article today, which I just see as I’m finishing this post, Prof. Krugman quite rightly notes the importance of industrial clusters to growth. He cites the Chinese supply-chains highlighted in the NYT series. But he entirely ignores the most famous and successful cluster on earth — Silicon Valley. How many jobs in Silicon Valley do we think are dependent on or symbiotic with Apple. It’s incalculable, but its a lot.

I asked Gov. Daniels what he thought.

“I won’t be reading Herr Krugman,” Gov. Daniels replied, “but I did read the New York Times, and it changes nothing. Just means Dr. K doesn’t understand the dynamism of innovation, either.”

— Bret Swanson