Over the last half decade, during a protracted economic slump, we’ve documented the persistent successes of Digital America — for example the rise of the App Economy. Measuring the health of our tech sectors is important, in part because policy agendas are often based on assertions of market failure (or regulatory failure) and often include comparisons with other nations. Several years ago we developed a simple new metric that we thought better reflected the health of broadband in international comparisons. Instead of measuring broadband using “penetration rates,” or the number of connections per capita, we thought a much better indicator was actual Internet usage. So we started looking at Internet traffic per capita and per Internet user (see here, here, here, and, for more context, here).

We’ve update the numbers here, using Cisco’s Visual Networking Index for traffic estimates and Internet user figures from the International Telecommunications Union. And the numbers suggest the U.S. digital economy, and its broadband networks, are healthy and extending their lead internationally. (Patrick Brogan of USTelecom has also done excellent work on this front; see his new update.)

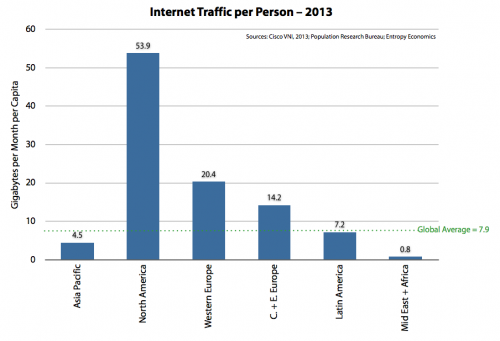

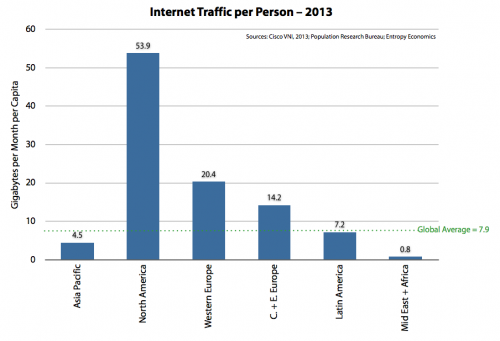

If we look at regional comparisons of traffic per person, we see North America generates and consumes nearly seven times the world average and more around two and a half times that of Western Europe.

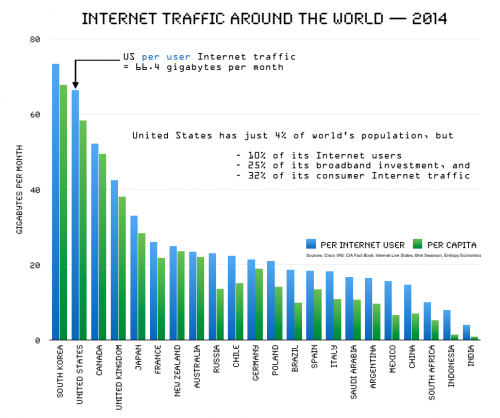

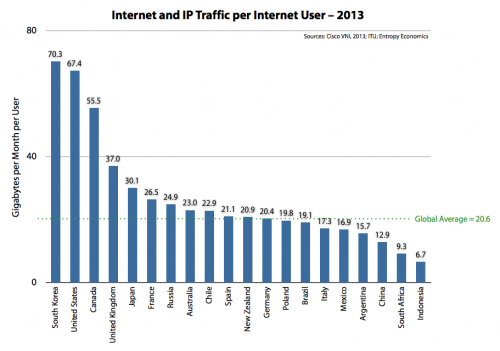

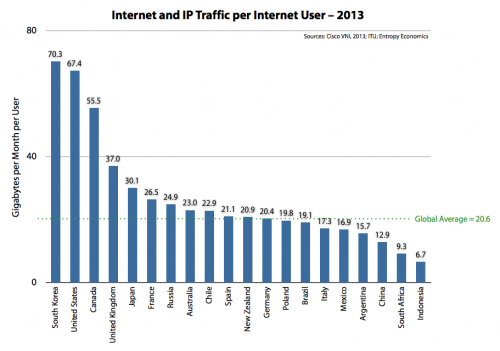

Looking at individual nations, and switching to the metric of traffic per user, we find that the U.S. is actually pulling away from the rest of the world. In our previous reports, the U.S. trailed only South Korea, was essentially tied with Canada, and generated around 60-70% more traffic than Western European nations. Now, the U.S. has separated itself from Canada and is generating two to three times the traffic per user of Western Europe and Japan.

Perhaps the most remarkable fact, as Brogan notes, is that the U.S. has nearly caught up with South Korea, which, for the last decade, was a real outlier — far and away the worldwide leader in Internet infrastructure and usage.

Traffic is difficult to measure and its nature and composition can change quickly. There are a number of factors we’ll talk more about later, such as how much of this traffic originates in the U.S. but is destined for foreign lands. Yet these are some of the best numbers we have, and the general magnitudes reinforce the idea that the U.S. digital economy, under a relatively light-touch regulatory model, is performing well.